How I Redesigned DMG’s Invoicing and Payments Product to Increase Gross Margin by 17%.

Context

DMG is a Pre-IPO B2B services marketplace for physical infrastructure. It provides facility maintenance services to major retailers countrywide. In July 2022, I was hired by Kumar Srinivasan, the chief product officer to redesign DMG’s fintech products through which DMG’s service provider submit their invoice and get paid for the services they provide for our customers.

The people problem I solved

Service providers, often older and technologically challenged, struggled with DMG’s invoicing software, spending days to submit a single invoice. This caused delayed payments, high abandonment rates and strained relationships with DMG’s Operational Coordinators (OCs), who were slow to respond to queries and issues.

The business problem I solved

Service providers found a way to bypass the Not-to-Exceed (NTE) value by adding non-catalog items with inflated prices, significantly impacting gross margins. Additionally, delayed payments disrupted cash flow, lowered service quality, and led to customer dissatisfaction, ultimately increasing provider churn and acquisition costs. To address these challenges, I was tasked with redesigning the invoicing and payments experience to protect gross margins, improve provider retention, and streamline the invoicing process for faster submissions.

My Contribution

0->1 Product Strategy, End to End UX Research + UX Design

Modalities

Web and Mobile

Vertical

B2B Fintech

Duration

July 2022 to Present

Team

This project was a true collaboration between myself, Chief Product Officer, Senior Director of Product, and the Finance and Operations Managers(2) and Development Team (15).

Solution

To tackle these challenges, I designed a more intuitive and efficient invoicing system with the following key features:

Simplified Interface: Tailored the design to be user-friendly, especially for older providers, making invoicing faster and reducing frustration.

Seamless Communication: Integrated direct communication channels between providers and Operational Coordinators, enabling real-time resolution of invoicing and payment issues and reducing the time required to submit invoices.

Feedback Mechanism: Introduced a feature for providers to rate and give feedback on Operational Coordinators, fostering accountability and improving issue resolution.

Verifying Non-Catalog Items to Protect Gross Margin: Warned providers that adding non-catalog items would delay payments due to manual verification. Providers could justify the addition with reasons and receipts, allowing coordinators to review and approve justified higher rates. This feature ensured fair pricing, preventing unreasonable costs while maintaining flexibility for legitimate cases. The solution helped in protecting gross margins by reducing overpayments for inflated rates and ensuring providers were fairly compensated where justified

Results, Metrics and the Butterfly Effect

Read the full case study below ↓

The problem I was asked to solve

Service providers were taking too many days to submit a invoice for the services they provide to customers through DMG’s invoicing product. This caused delayed payments and high provider churn. Additionally, Service providers bypassed the Not-to-Exceed (NTE) value, which sets a maximum cap on rates for commonly used parts and equipment, by adding new items that were not in the catalog and had inflated prices. This practice significantly impacted gross margins.

DMG hired me to redesign the invoicing and payments experience to reduce the provider churn, increase gross margins and reduce the time taken to submit the invoices.

Utilized UX Research to find out the root causes of problem

When I joined DMG, I was stepping into uncharted territory. Facility maintenance and fintech were entirely new to me, but I saw this as an challenge. To make sense of the landscape, I built a UX research plan to uncover user pain points and the root causes behind the problem.

The Game Plan

I approached the challenge methodically, breaking it into key steps:

1. Defining Research Goals: I started by asking, “What questions do we need to answer?” This clarity helped me to select the right UX Research methods.

2. 10 User Interviews: Crafted an interview script questionnaire to conduct 10 interviews with service providers to hear their pain points.

3. 2 Field Studies: I shadowed operational coordinators, watching them interact with DMG’s products in real-time.

4. Competitor Analysis: Analyzed invoicing flows of Bill, QuickBooks, Stripe, Zoho Invoices, and Square to identify best practices.

5. Countless Zendesk tickets and Support calls: These became my treasure trove of insights, even joining live calls to resolve provider issues directly.

Through this process, I wasn’t just gathering data; I was building relationships and empathy for the providers who relied on us.

Root Causes found

Cause #1 The current product is not designed for technologically challenged and older users.

Evidence: “I don’t find the Invoice Number on the Screen.” from User Interview(P-08)

Cause #2 Delay in getting a response from DMG’s Operational Coordinators for the issues that providers have.

Evidence: Data Analysis from Zendesk tickets revealed that the average time to resolve a service desk ticket was 9 business days

Became friends with the Finance and Support teams to discover business problems

The more I collaborated with Finance, Operations, and Support, the clearer it became how crucial this problem was. I made it a point to connect with them whenever possible—digging into the context, uncovering the history, aligning on shared goals, and discovering business problems.

1. Service providers circumvented the Not-to-Exceed (NTE) limit, which caps rates for standard parts and equipment, by introducing non-catalog items with inflated prices, leading to a decline in gross margins.

User Flow for Adding Non-Catalog Items to the Invoice

Starting with the End in Mind

I mapped goals to measurable signals of success, aligning them with metrics to track progress.

DMG implemented a Not-to-Exceed (NTE) value and created a catalog for parts and equipment to cap the rates providers could charge for few parts and equipment, ensuring fair pricing and protecting gross margins. However, providers started adding new, non-catalog items with inflated rates.

For example, a "long auger" was often added at a higher price despite an existing catalog entry for a standard auger at a reasonable rate. This practice decreased DMG's gross margin and profitability.

I built the first release to prevent revenue loss and protect gross margin from inflated rates on Non-Catalog Items added by the providers.

I reframed this constraint into an opportunity

To solve this problem, I came up with two possible design solutions.

Option 1: Raise a request to add Non-Catalog Items

I could not let the provider add a non-catalog item and if they still want to add a non-catalog item, they had to raise a request to the Operational Coordinator with a justification for adding a new part with higher rates. The coordinator to then verify the request, manually add the item, and send the invoice back for submission.

It’s trade-off

This option completely solved the problem inflated rates but risked upsetting providers who were used to a flexible process. It also significantly increased the workload on OC’s.

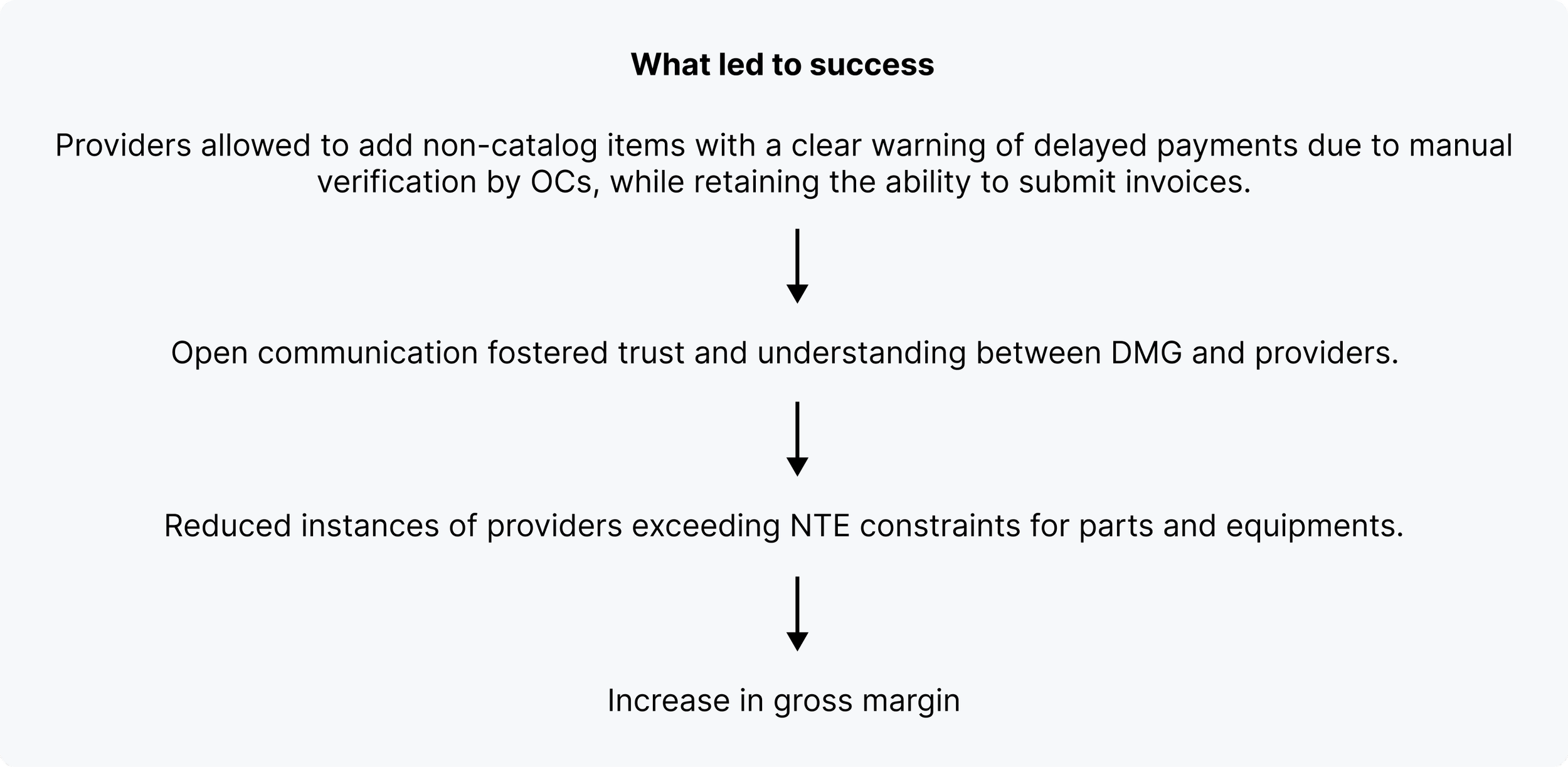

Option 2: Allow adding non-catalog items with a warning

I could still let the provider add non-catalog items but warn that doing so would delay payments due to manual verification by OCs.

It’s trade-off

This option maintained the flexibility for the provider to add non-catalog items and was easier to implement but did not fully solve the problem of inflated rates, leaving some margin erosion unresolved.

I chose to go with the first option, prioritizing long-term gross margin improvement despite the trade-off of operational strain. With strong organizational buy-in and a dedicated team of principal engineers, we implemented this experience.

Not the result I hoped for

The rollout faced pushback from providers and overwhelmed operations, with research revealing two key issues

Learning and Pivoting to the second design option

I learned the importance of aligning design with operational readiness, especially in a B2B services marketplace. Striking a balance between provider satisfaction and achieving business goals was crucial, leading me to pivot to Option 2.

Leaning on transparency, research, and collaboration led to success

I validated option 2 through user research and click-through prototypes with providers, then collaborated with operations and finance teams to assess its impact and ensure cross-departmental alignment.

Connecting providers with the OC faster to streamline NTE increases, reducing effort and invoice submission time.

When providers didn’t receive a response from the OC after submitting a request, they would call DMG’s front desk to ask for the OC’s contact number. They would then reach out to OC to resolve their queries or request an increase in the NTE for parts and equipment.

To address this issue, I came up with two design solutions:

Implementing a chat-box that allows providers to message the OC in real time.

Displaying the OC’s contact number on the invoice for easy access.

After syncing with the engineering on the tradeoff’s, I opted for the second solution since it was quick to implement. Meanwhile, I collaborated with the product team to add the chatbox feature to the roadmap. This decision significantly reduced invoice submission time by eliminating the need for providers to search for the OC’s contact information.

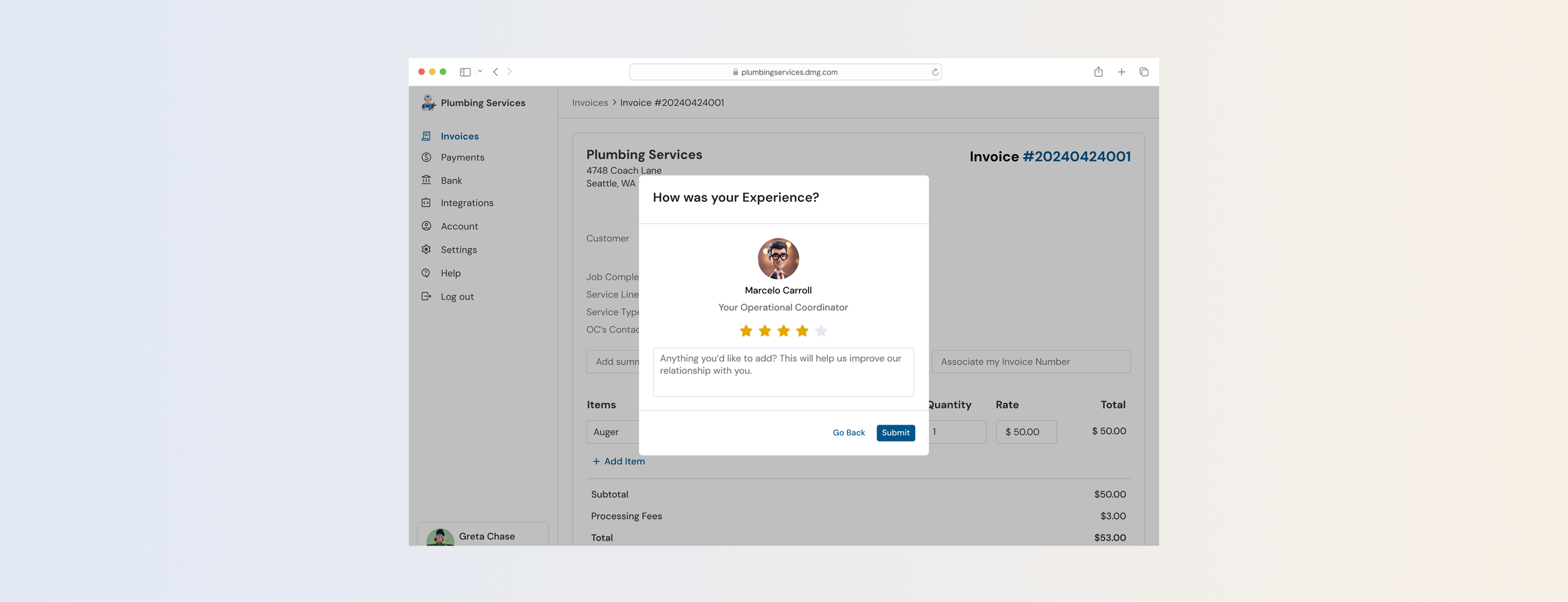

I then built out another feature where providers could rate their experiencing working with OC

In order to increase the accountability amongst OC’s to respond to provider’s requests/queries on time, I introduced a strategy through which Rating DMG’s Operational Coordinator empowers the provider to voice their concerns via feedback with the OC’s. As a result, accountability amongst OC’s is increased, encouraging timely actions and improved high-quality experiences for providers. The same way Uber ensured riders' safety and enjoyment by allowing them to rate their drivers. This helped OC’s encourage timely actions and improved service, which led to decreased time to submit the invoice.

I then built out next release, focusing on simplicity and accessibility

I conducted a heuristic evaluation to identify visual design issues, including typography, color and redundancy. Using WCAG accessibility guidelines, I redesigned the experience to be intuitive, accessible, and visually polished making it easy for the provider to navigate through the product and submit the invloice and get paid.

Before

1. Tiny text causing reduced readability and visibility.

2. Invoice information is placed horizontally making difficult to scan causing cognitive overload.

After

1. Utilized high -contrast colors to align WCAG accessibility guidelines.

2. Left-aligned all the information so that the user’s can scan through the invoice easily.

Before

1. Redundancy caused by Input text labels and headers leading to a cluttered UI

After

1. Removed the Input text labels and increased the font size to promote clear readability.

I then used data from Datadog, Mixpanel and usability testing to test my assumptions and refine the product

I noticed that users forgot to click on save as a draft button to save the work they have done on invoice. So we implemented the auto save feature. I have also removed activity timeline and scope in the final iteration as Mixpanel showed significantly low engagement.

Impact: Increased Gross Margin by 17%, Driving DMG’s Growth into a Pre-IPO B2B Services Marketplace

I tracked product usage and found that we reduced invoice submission time by 15 days and improved provider retention, meeting all our UX metrics. These results not only enhanced the provider experience but also validated our success in achieving key business goals.

Next Steps: Continuing to Innovate

1. Designing an AI-powered invoicing and payment system to help providers submit invoices more efficiently by detecting errors and offering real-time suggestions.

2. Automating workflows, invoice submissions, and payments to streamline operations and reduce manual effort.

Key Learnings

Deep Industry Research is Essential

To design impactful solutions, it's crucial to understand the industry and domain. In my case, I had no prior experience in fintech or facility maintenance, so I collaborated with subject matter experts to navigate constraints and design for the unique needs of users.Pivoting is Part of the Process

Mistakes happen—some big, some small. What matters is how quickly you adapt. When the first approach didn’t work, I swiftly pivoted to an alternative solution that proved more effective.Designing Within Constraints Fuels Innovation

Working within limitations helped me grow as a designer. I had to account for a user base that was both technologically challenged and accustomed to decade-old workflows. Providers had been adding non-catalog items for over ten years, making behavior change difficult. Viewing constraints from different perspectives led to creative solutions.Facility Maintenance is a Trillion-Dollar Industry with Immense Potential

Despite its size, the industry operates on outdated technology, presenting significant opportunities for innovation and modernization.